Six steps to finance

Steps to your finance approval.

Buying houses is typically one of the largest purchases we ever make, but don’t let obtaining finance for it overwhelm you. Just take each of these six steps one at a time, and know Direct Credit Home Loans are there to help at every stage.

Generally Direct Credit can issue you a conditional approval with in 48 hours of receiving your application and supporting documents.

Six Steps to home loans explained:

- Conditional Approval

- Property valuation

- Formal approval

- Insurance

- Loan documents

- Settlement

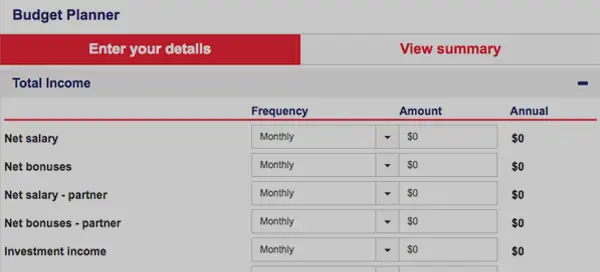

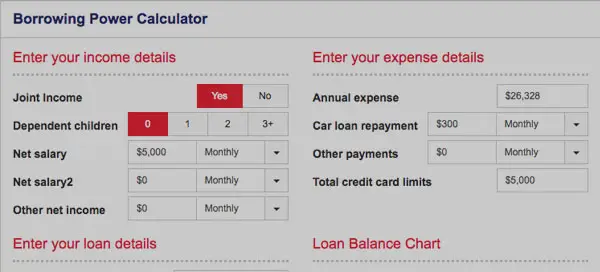

Enter basic information in our borrowing power calculator to get a quick understanding of how much you could be able to borrow based on your existing circumstances.

Enter basic information in our borrowing power calculator to get a quick understanding of how much you could be able to borrow based on your existing circumstances.

4) Take out insurance

All lenders require you to take out building insurance in case of an accident, such as fire. If you do not have insurance and your property is destroyed, then you will be paying off a loan for something that is no longer there!

Make sure your house is insured for at least the minimum we request, and it notes the correct interested party / mortgagee.

We will advise you on the lender to be noted on the policy. The lender must be noted as an interested party or first mortgagee

If you are purchasing a property, this insurance must cover you from the time of acceptance, not when it settles. Most insurers will issue you a cover note, so if you do not go ahead with the purchase you can cancel the insurance.

It’s important to protect your ability to meet your repayments. So we also provide insurance to help you manage and unexpected life events – because we want you and your family to enjoy a secure future in your own home.

Our partner Financial Planners can advise you on the most appropriate insurance policies. This is obligation free – but it may make all the difference to your future.

1) Conditional home loan approval

You can apply for a home loan online, or call us first to discuss your needs. Once we conditionally approve your loan, we will issue you a letter of offer with any outstanding items you still need to arrange

These usually include a property valuation, title insurance and certificate of building insurance. We may also need to check some facts, such as arranging an employment check.

Your Direct Credit Home Loans credit manager will discuss these with you and help you make sure you meet any conditions

2) Property Valuation

We always request a valuation of the property you will use to secure the loan. These are done by an independent registered valuer, who may need to enter the premises. Others carry out a kerbside valuation.

Valuers take in to account your property location, its condition and any improvements undertaken, and any special or adverse features, recent sales in the area and other factors. It’s not an exact science – different Valuers may come up with a different valuation.

3) Formal approval

Once all conditions have been met and the property valuation is complete, we will issue you with a letter of formal approval.

If you’re purchasing a property, this is important: if you have not received a formal approval before your finance is due and you cannot get an extension, you may be legally liable to buy the property even if you don’t get finance

Once formal approval has been obtained, we will issue the solicitors with instructions to draw up and send out formal loan documents to you directly, or to your solicitors.

5) Loan Documents

Once loan documents have been sent to you (or your solicitor) you will need to sign them after your solicitor checks them for you. They can also help you sign in the correct places to save time as if you make mistakes they will be sent back.

You can also get a Justice of the Peace to witness your documents, and if your refinancing this may be a simpler option. But as your house is probably your most valuable asset (and your mortgage is a significant debt), the solicitor’s fee is a wise investment for your piece of mind.

6) Settlement

The moment has arrived at last – settlement day. If you’re buying a property, this is the moment you own it. If you’re refinancing, this is the day your other debts are paid off or extra equity is made available to you, and we take over managing your mortgage.

On settlement day our solicitors will arrange to meet with your solicitor (if you’re using one) and the vendor’s solicitor to arrange the necessary paperwork and funds transfer.

You don’t need to attend this meeting. We will call you once we have confirmed that settlement has been completed.